Buying a Condominium in Toronto is no easy task. Finding the right building is tough; finding the right unit in the right building seems, at times, insurmountable. Understanding Condo Fees is crucial to success in your purchasing journey. A full comprehension of the topic can make the difference between a successful purchase and a home buyer’s nightmare.

What Are Condo Fees?

Condo Fees (legally referred to as Common Expenses), are a monthly fee payable by unit owners to the Condominium Corporation. The Condominium Act mandates the payment of these fees. Some buildings may refer to condo fees as “Maintenance fees”, or “Common Elements fees”.

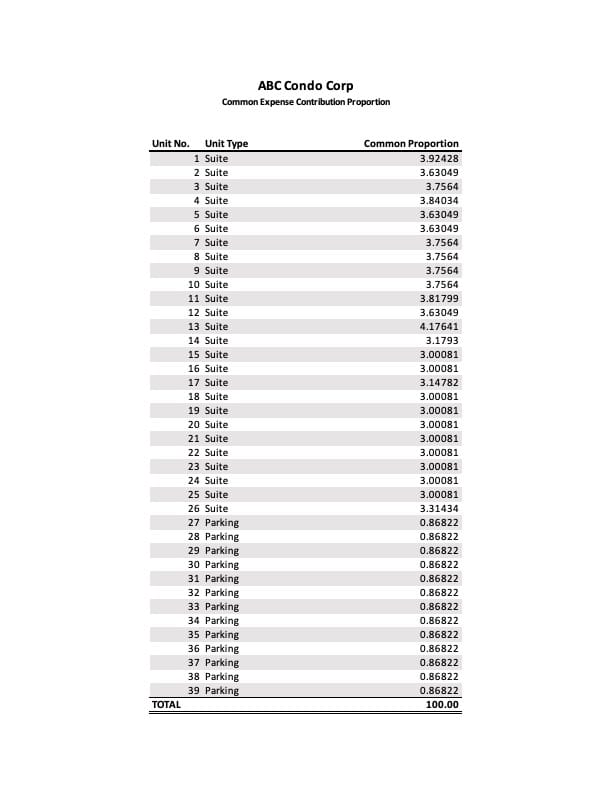

The amount payable is proportionate to that unit’s apportioned interest as described in the condominium’s declaration. Lockers & Parking units, if owned, can also require contribution. The incorporating documents, such as the Declaration and Description, contain the breakdown. You can also find it in the Status Certificate.

Owners cannot be exempt from paying common expenses. Condo liens occur when an owner defaults on payment. Read more on common expense default here.

Common Elements Condominiums – condos with no units – can also charge common expenses. This is very common in Parcels of Tied Land (POTL).

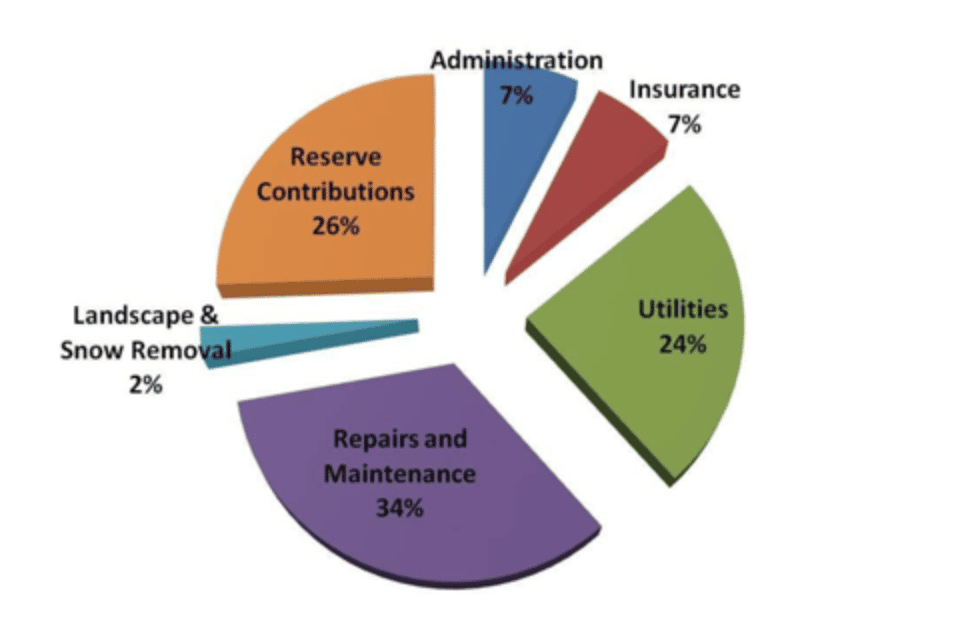

What do These Fees Cover?

Condo fees are a monthly prorated contribution to building operating expenses. Operating expenses vary by condo corporation and can include things like maintenance expenses, reserve fund contribution (see below) building insurance, hydro, water, and even internet.

Depending on a building’s construction style, condo fees can include utilities, like hydro and water. At times, buildings may also sign bulk agreements for cable TV, internet, or other digital services, and choose to pass the subsidized cost to the residents in the fees.

When can Condo Fees Increase?

Regular condo fees typically increase once per year. According to the Condominium Act, the common expenses must be stated in the condominium’s declaration. This document will also include each owner’s share payable to the common expenses.

An operating contribution and a reserve fund contribution make up condo fees.

The operating contribution is based on the annual budget of the condominium corporation – which must be detailed and shared with the owners. Adjustments to common expenses occur usually at that time.

Reserve Fund Studies

Each Condominium must have a Reserve Fund. This fund is essentially a large bank account with sufficient balance to cover the cost of major repairs.

A mandate of Condominiums in Ontario is to undergo reserve fund studies. New condo corporations have to perform a reserve fund study. Following this, condo corps must redo or update the study at least every three years. These studies outline a 30 year plan of predicted repairs and replacements necessary as well as their inflated costs.

The corporation adjusts the owners reserve fund contribution based on the findings of the study.

According to the Condominium Act, initial contributions to a reserve fund must be 10 per cent of the operating budget. After the initial study, the contribution amounts may change dramatically.

Most condominium fees rise substantially when this occurs (in the first 1-2 years of new condo ownership). It is important to ask if about this study before you buy.

At times, the reserve fund may not be sufficient, and contributions to common expenses will not replenish it fast enough. In this case, the board may choose to levy a special assessment.

Special assessments are usually 1-time payments. However, directors can break them into smaller interval payments (if the assessments are extraneously large). Use cases include:

- To replenish the fund,

- Pay for a particularly large repair, or

- Pay into proceeds of a lost lawsuit.

Special assessments are common expenses. An owner’s refusal to pay will result in a lien.

What does the fee Include?

The operating contribution to a condominium budget can vary widely. Some buildings include hydro, water, & cableTV/internet in their common expenses. Other buildings may choose only to include the bare minimum (building insurance & maintenance/management costs). It depends on the decisions of the board and the original builder’s intentions. For example, the developer could install hydro meters for every unit, eliminating the need for hydro to be shared via condo fees.

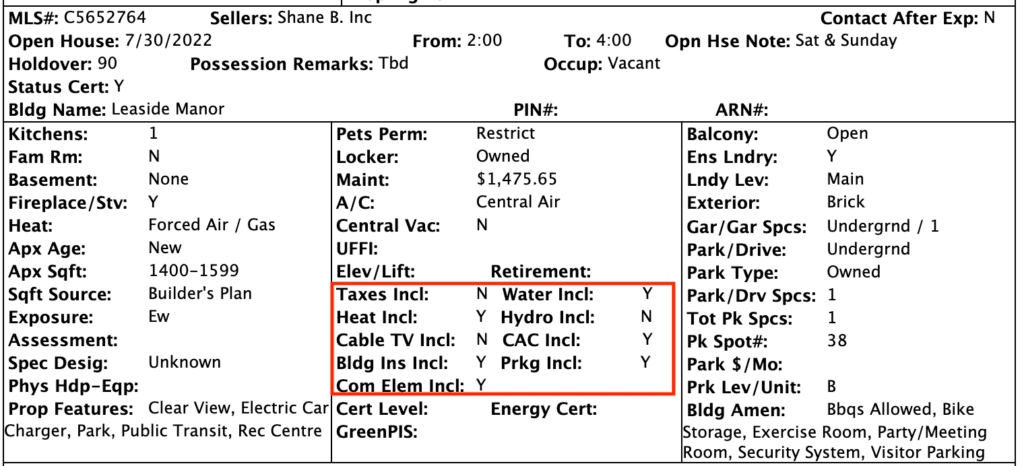

The MLS clearly states the inclusions of a condo fee. It’s important to check which expenses are included in your payments.

This will also make a difference when applying for mortgage financing. Banks estimate expenses not covered by condo fees as part of their debt service calculations.

Are Condo Fees Based On Square Footage?

The apportioned common expense contribution, or condo fees, are not always solely based on the square footage of a unit – though it is certainly a factor. Other factors that may influence the proportion payable include:

- Exclusive use of any common elements (for example, a private terrace or balcony)

- Parking space (size & location), locker size

- Services or amenities available to a unit – i.e. a secondary private elevator

- Operating cost or share ownership in Condo Amenities

The most accurate way to check the proportion of condo fees payable is via the declaration or status certificate.

Are Condo Fees Subject to GST/HST?

Residential condo fees are not subject to GST or HST. The Excise tax act specifically exempts residential condominium units. However, commercial condominium units are subject to GST or HST unless the small supplier rule is met.

The Small Supplier Rule dictates that a supplier collecting less than $30,000 per year does not need to register and collect GST/HST. For more information, its recommended you contact a tax professional.

Can I Expense my Condo Fees?

If you are a real estate investor, you are likely wondering if common expenses can be deducted from rental income. Generally, this is permitted as the fees would be considered, in essence, a cost of goods sold. However, expert accounting advice is recommended in this field.

Are Condo Fees Included in Rent?

Unless otherwise stated, its generally accepted (in residential leases) that monthly common expenses are included in the gross (total) rent payable. However, there are instances where the rent does not include condo fees.

Examples of this would be a commercial triple-net lease, where the lessee is responsible for all operating costs (including taxes, maintenance, and insurance, or TMI).

The MLS has a section that allows landlords to describe what is included in the rent. It is normally easier to include condo fees and then deduct them from your income statement. If you’re looking to purchase a property for rental income, its important to understand how this may affect your bottom line.

Condo Fees & You

Condo fees are a complex and diverse topic and should be thoroughly understood prior to purchase. If you have questions about condo fees, Contact Us.