Buying a home in Toronto is likely one of the single largest financial transactions one will make in their lifetime. In addition to ensuring the property adequately fits your needs, it’s just as important to have a firm understanding of the home’s operating cost. Toronto Property Tax is the most prevalent costs of ownership. Some properties have mortgages. Some have condominium maintenance fees or POTL Fees. However, ALL properties carry the obligation of Property Tax.

What is Property Tax?

Property Tax is a fee or levy issued by the local municipality for the purposes of maintenance, infrastructure development & education. The Municipal Act (Part 8: Municipal Taxation) grants municipalities authority to charge such fees, issue fines & penalties, and force collection of property taxes.

Unlike the one-time payment of Land Transfer Tax., property tax is a recurring annual obligation.

How to Calculate Property Tax

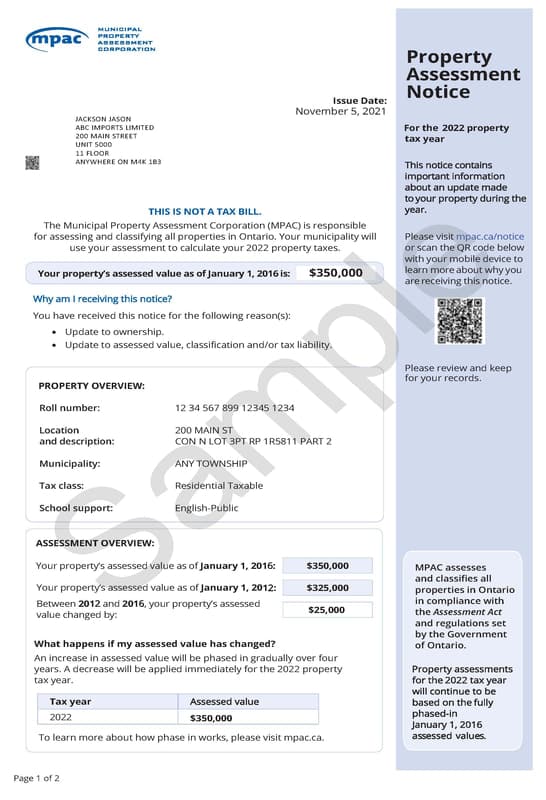

In Ontario, Property Tax is calculated as a percentage of the assessed value of your home by the Municipal Property Assessment Corporation (MPAC).

MPAC assesses the value of each property in Ontario once every four years. As the assessed values between these four year periods tends to be quite drastic, MPAC will pro-rate the assessed value in four equal increments.

This value is then “phased-in” over the next four year period. The cycle repeats once the value is fully phased-in. MPAC will issue a Property Assessment Notice to the owner, informing them of the new values.

Home owners have the ability to dispute these assessed values should they believe them to be incorrect.

Based on this phased-in value, the City of Toronto (or local municipality) will apply a predetermined tax rate to your property and issue bills accordingly.

Toronto Property Tax Rates

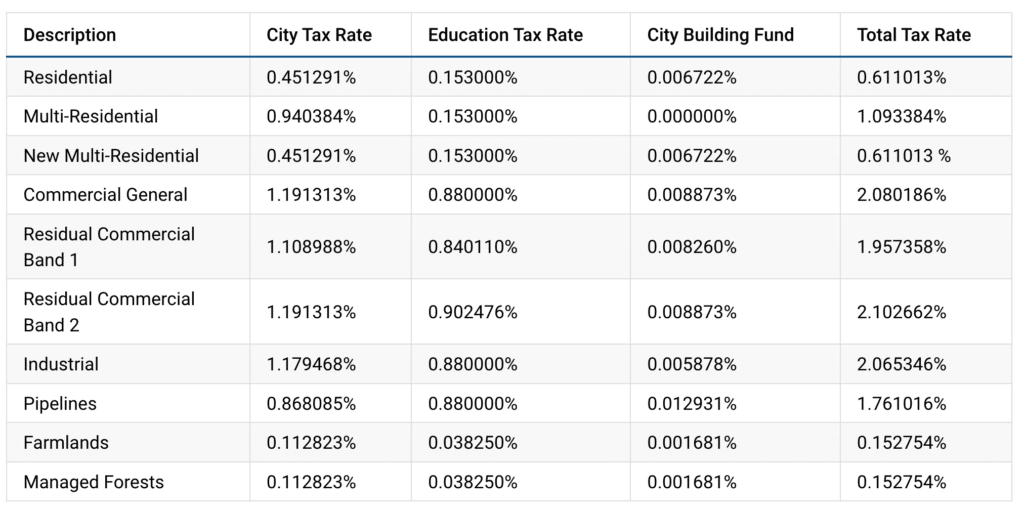

City budget, financial operating requirements, and provincial restrictions or allowances all affect tax rates. Toronto’s property tax consists of the City Tax Rate, the Education Tax Rate, and the City Building Fund.

Interim Tax vs Final Tax

As property tax is a large obligation relative to other (non-financing) home ownership costs, cities typically want to ensure residents have enough time.

However, budgets for the year (and subsequently, tax rates) are not typically financed until the end of the first quarter of the year. Because of this, the city usually issues two bills: an interim bill and a final bill.

The Interim Tax Bill estimates the taxes for the year and issues a bill for half the amount. Later in the Year (usually by May), the municipality sends the final tax bill, approximately equal to the interim bill, plus or minus the adjustment difference between the estimate and the actual tax rates for the year.

In most cities, your interim tax bill is half the previous year’s final bill

Residents can use the Property Tax Calculator by the City of Toronto to estimate taxes. The Estimator requires the assessed value delivers the predicted estimated tax for the property in the current year.

Property Tax Arrears & How to Pay

Most Municipalities allow residents to pay in instalments (monthly, bi-monthly, etc). You should check with your local municipality for options.

Installment Dates

In Toronto, regular instalment due dates are:

Interim Bill: March 1, April 1, May 2

Final Bill: July 4, August 2, September 1

Unpaid taxes can accrue interest and penalty fees as per the Municipal Act. The city has the authority to issue notices against title claiming unpaid property taxes.

Unpaid property taxes are registered in super priority. This means that although they may occur on title after mortgages and Condo Liens, they take priority over ALL other instruments and obligations.

As per The Municipal Act, if taxes remain unpaid for two years, the municipality can force the sale of the property to recover unpaid taxes.

Toronto Property Tax can be a confusing topic. It is important to understand how taxes on a property and their assessed values may affect you. For more information, Contact Us for a free consultation.